They don’t understand how cryptocurrency works either

Modern money is broken.

It’s rapidly losing its purchasing power due to purposeful inflation.

Younger people are blindly migrating their trust to cryptocurrencies.

Governments are scrambling.

Technologists are innovating.

The battle is raging.

Fiat vs. crypto.

Government vs. private.

Control vs. autonomy.

And both sides are wrong.

The first thing we need to understand about money: All currencies are notional, representational, and inherently worthless.

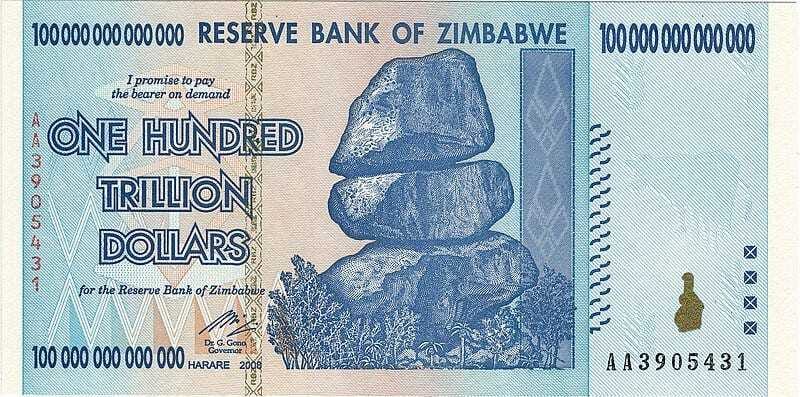

Technically speaking, I’m a trillionaire.

I own a Zimbabwaen $100,000,000,000,000 note.

I bought it five or six years ago for a couple of bucks.

It’s a good reminder that money is inherently worthless.

Literally as worthless as the paper it’s printed on.

The second thing we need to understand: Money is only as valuable as the trust behind it.

Money is spiritual.

A “legal fiction,” as Yuval Noah Harari puts it.

It’s entirely made up.

Anything can be money if two or more people put their trust in it.

The Roman empire paid its soldiers in salt. (It’s where the word “salary” comes from, and why we say someone “wasn’t worth their salt.”)

For 390 years, the official currency in the ancient Chinese state of Qi was epic bronze knives.

The monetaria moneta sea snail was used as currency throughout the Pacific.

In the 1600s, people in Newfoundland used dried cod.

The Dutch supposedly bought Manhattan for $24 worth of beads.

I don’t know about you, but I wouldn’t like to be paid in salt, snails, or fish.

Maybe knives.

So how does one build enough trust to give their paper or digital currency value?

By backing it with something powerful.

There are three ways to back a currency: value, violence, or a vision.

Value

Currency used to be backed by real assets. Goats, sheep, bread, cheese, land, wives, children, slaves. People gave each other credit because they knew they had the underlying consumables to pay.

For 70+ years, the United States backed its currency with gold. Physical gold, ironically, didn’t and doesn’t have much useful value in the real world — you can’t eat it, build houses with it, or power your car with it — and people are now realizing gold functions better as a currency and isn’t real value. But during the gold standard, its tangibility and limited nature at least gave the economy some stability.

Violence

On August 15, 1971, the United States government under Richard Nixon decided to cross the Rubicon and untether the USD from the gold standard.

It wasn’t inherently a good or bad decision. Mining, after all, is disastrous for the planet. And it isn’t cheap to maintain giant steel safes and pay military personnel to defend shiny rocks in 100,000+ acre complexes like Fort Knox.

Pre-1971, an American dollar bore a promise that you could take it to the Federal Reserve and exchange it for an equal amount of gold. After the gold decoupling, what was the new backing for your pretty piece of paper?

The promise was that the American government would maintain your piece of paper’s face value, even going so far as to seize someone’s property if they fail to pay you back.

In essence, the $USD became a mafia contract. To this day, the $USD is the most powerful currency in the world because, when you boil it down, it’s backed by the might of the American military-industrial complex. Real power.

Other nations do the same thing. I’ve been to North Korea, where it’s illegal to use $USD. I’ve been to China, where they’re now cracking down on crypto while rolling out their own digital surveillance currency. Real power.

Vision

The vast majority of cryptocurrencies aren’t backed by any real value. Nor do they have the muscle-power of the state to bully and coerce people. All they can do is share a vision (typically in the form of a white paper) and hope that enough people invest in their dream.

(And by “invest” I don’t mean “buy and hodl coins.” I mean, “develop genuinely useful apps on top of blockchain frameworks that can improve the lives of billions of people.”)

As we’ve established, a currency’s worth boils down to trust. People used to trust in credit and gold and violence, and now they’re trusting in a vision of reality that may or may not come true. In most cases, people haven’t even read the white papers. Their vision is simply “This coin will go to $10 by 2025” or “This coin is going to the moon.”

It remains to be seen if BTC/ETH/ADA’s private visions will prove more powerful than the violence of public powers like America and China.

How Modern Money Is Created

Fiat currency is now created as private debt in one of two ways:

Public debtGovernments and central banks print money out of thin air (via treasury notes/bonds) and call it “stimulus” or “quantitative easing.”

Private debtYou go to the bank and ask for a mortgage or a car loan. A banker types on a computer and creates credit in your account. Now you have to pay it back with real cash. That’s it. New money has been created. (If someone deposits $10 in a bank, the bank can loan out $9, then book that loan as an asset, which allows them to loan out eight more dollars, book that loan as an asset, loan out $7, etc. It’s called the money-multiplier effect, and it’s the reason you can’t afford to buy a house. The end result? Almost all new money is created as debt.)

Welcome to the insane fractional-reserve banking system.

That can’t be it, right?

Surely bankers and governments shouldn’t be able to type numbers into a screen and print money out of thin air. Wouldn’t that inflate house prices and stock prices and put the squeeze on billions of people who have to work hard to pay back fake loans (plus interest) with the real value of their real labor? Wouldn’t printing money make currency worth less every year until $100 trillion doesn’t buy a loaf of bread?

Sadly, governments don’t care about your economic wellbeing.

“The majority of money in the modern economy is created by commercial banks making loans.” — Bank of England

“Even though I work at the Fed, I really hadn’t thought a lot about money creation in awhile so I looked up your question and basically, yes, banks create money by what is called fractional banking. Banks take your deposit, hold a certain % in reserve, and lend out the rest, which then gets redeposited, spent, etc.” — My friend who’s worked for 20+ years at the U.S. Federal Reserve

“Private commercial banks create money when they purchase newly issued government securities by making digital accounting entries on their own balance sheets. Money is also created within the private banking system every time the banks extend a new loan, such as a home mortgage.” — Bank of Canada

Now you see why people hate bankers.

Modern magical money creation is so simple and insidious that it’s downright repellent to most civilized minds.

Back in the day, someone would show up in London with 500 sheep, 1,000 bottles of Madeira, or a chest full of gold bullion to receive a note of credit that was redeemable at a sister bank across the Atlantic in New York.

The value came first.

Now, because humans are such a wonderfully hopeful (and often delusional) species, we do it the other way around — we create new money out of thin air and hope the value chain will catch up.

It never does.

The Problem With Cryptocurrency

Crypto does the exact same thing as fiat currency.

It prints (“mines”) magic money out of thin air.

Crypto isn’t backed by value or violence, but by a vision… trust… a quasi-legal fiction… human imagination.

When you look at it objectively, what is cryptocurrency? Nothing but bytes in a file, to which people have temporarily assigned extravagant prices.

As one of my commenters put it:

“When someone gives ~$40,000 to get 1 Bitcoin, what actually happens is some bytes in a file change their values. People give a pile of cash to have some bytes in a file associated with them. Sounds like a good definition of insanity. Especially bearing in mind that anyone can create such files at will. There are currently thousands of cryptocurrencies, [but there could] actually be millions or billions, and all of them are backed by nothing. Just files.”

Even in a future where people may theoretically place their faith in a wide range of vision-backed coins, it remains to be seen if governments will legally enforce the transactions or just make all private coins illegal in favor of their own digital surveillance currencies.

So how should money be created?

Right now, the global financial system is essentially a precariously stacked house-of-cards pyramid of glorified IOUs.

We need stable money that is violence-free, value-backed, and vision-loaded. As one of my commenters recently posted:

Not only is the current process of money creation corrupt, but it produces very poor quality money. Money is ideally a neutral, globally fungible trade medium. We need money to be a fixed unit of cost for planning, stable store of value for saving, with global acceptance for maximum utility, and nothing else.

I 100% agree.

We are on an inevitable march toward a unified global currency, and blockchain technology could be the key to decentralizing that power. (Not to get to esoteric, but if it were up to me, we’d back that “GlobalCoin” with the thing of ultimate scientific value — the joule. It is quite literally our most basic unit of work — a transfer of energy. Make it happen, blockchain nerds!)

The key is this: We need to strip money-making power away from banks and return it to a democratic, accountable, and transparent process. We need to create new money free of debt, not by lending money into the economy but by spending it into real eco-assets via blockchain-built infrastructure banks.

Where Do We Go From Here?

First, a macro note: Don’t set your heart on riches. Don’t put your hope in wealth. Love others, but don’t trust human nature and the money it creates.

Second: Prepare for fiat hyper-inflation or your money is worthless.

Third: Get educated. I encourage everyone to check out Positive Money and invest <30 minutes in watching their eight videos on money creation.

Fourth: Be cautious of the crypto Ponzi scheme.

Hundreds of millions of people have made bets on various vision coins, but what if they’re missing the whole point of this amazing blockchain experiment? What if crypto, like all fiat currency, is just a means to an end?

On any given day, the global crypto market cap is over two trillion dollars. Some people think it will go to ten or even one hundred trillion.

Imagine if instead of betting on meme coins like a Ponzi scheme, that hundred trillion was invested in building apps on blockchains instead.

Imagine if it was invested in protecting oceans and forests by hodling stablecoins backed by real eco-assets.

Imagine if that money was used to finance a blitzscale transition to 100% renewable energy, 100% organic food, and making the move to a circular economy that works for everyone, especially the estimated three billion people who will be forced into slums in our lifetime.

Some of the more altruistic crypto speculators are doing so as a protest vote against the hyper-elites who don’t care if we starve. Wouldn’t re-allocating to eco-investments be the ultimate stick-it-to-the-man? Society could invest ten trillion dollars in our planet and bankrupt the oil companies overnight.

Now imagine if the entire $360+ trillion global economy took a democratic, debt-free, violence-free, value-backed approach to money creation.

That’s a vision worth investing in.

Read Next

Follow Jared on Medium and subscribe to Personal Finance.